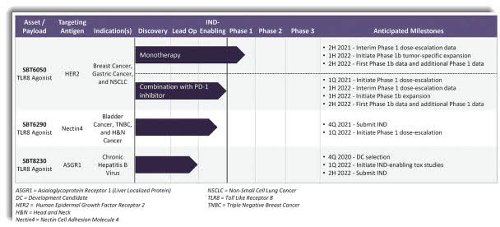

Get a free copy of the research report on Silverback Therapeutics (SBTX).The company offers SBT8230 to treat chronic hepatitis B virus infection by eliciting an anti-viral immune response by targeting TLR8 activation to the liver. Silverback Therapeutics, Inc, a biopharmaceutical company, develops tissue-targeted therapeutics for the treatment of chronic viral infections, cancer, and other serious diseases. Silverback Therapeutics Company Profile ( Get Rating) Institutional investors and hedge funds own 85.98% of the company’s stock. Finally, Ensign Peak Advisors Inc bought a new stake in shares of Silverback Therapeutics during the fourth quarter worth about $2,730,000. Morgan Stanley now owns 638,701 shares of the company’s stock worth $6,374,000 after acquiring an additional 625,477 shares in the last quarter. Morgan Stanley increased its position in shares of Silverback Therapeutics by 4,729.9% during the third quarter.

Millennium Management LLC now owns 953,691 shares of the company’s stock valued at $9,518,000 after buying an additional 944,661 shares during the last quarter.

Millennium Management LLC grew its holdings in shares of Silverback Therapeutics by 10,461.4% during the third quarter. now owns 2,974,228 shares of the company’s stock worth $10,440,000 after buying an additional 1,200,538 shares during the last quarter. raised its holdings in Silverback Therapeutics by 67.7% during the first quarter. Nextech Invest AG bought a new stake in shares of Silverback Therapeutics during the fourth quarter valued at approximately $12,721,000. Large investors have recently made changes to their positions in the business. Equities research analysts forecast that Silverback Therapeutics will post -2.04 EPS for the current fiscal year. The company reported ($0.70) earnings per share for the quarter, missing analysts’ consensus estimates of ($0.67) by ($0.03). Silverback Therapeutics ( NASDAQ:SBTX – Get Rating) last released its earnings results on Thursday, May 12th. The stock’s 50-day moving average price is $3.27 and its two-hundred day moving average price is $4.66. The company has a market capitalization of $122.66 million, a PE ratio of -1.28 and a beta of 1.10. Silverback Therapeutics has a 12 month low of $2.80 and a 12 month high of $35.63. Shares of SBTX opened at $3.49 on Wednesday.

0 kommentar(er)

0 kommentar(er)